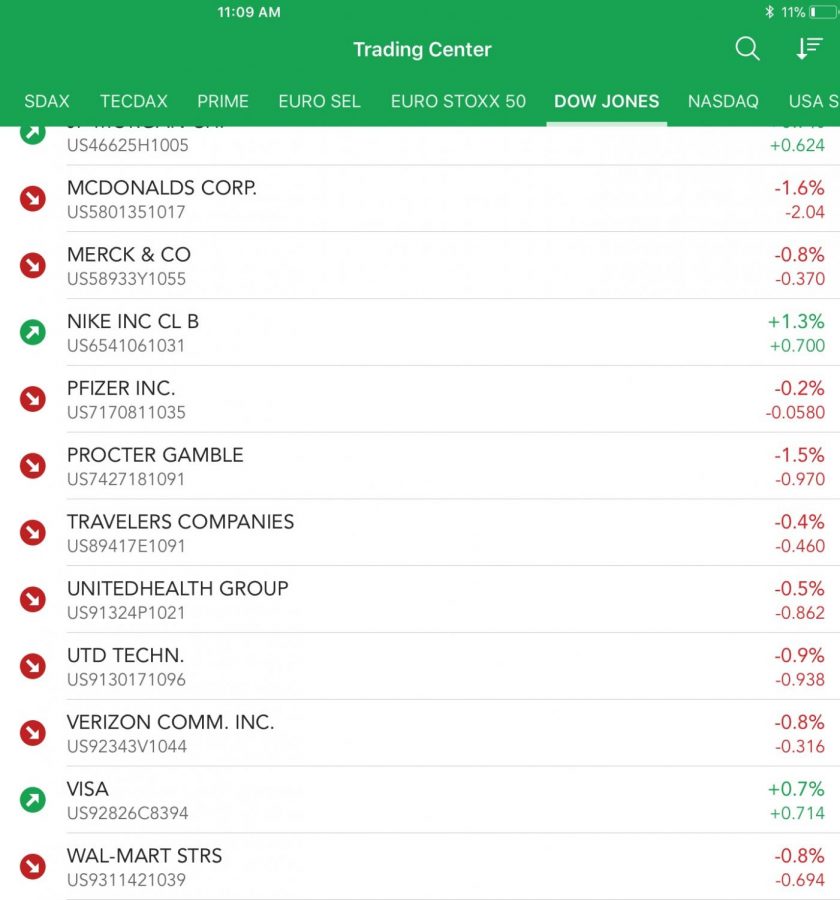

Dow Breaks History With Recent Drop

Last week was a rough one for the Dow Jones Industrial Average, known as the Dow. Though the drop in the Dow last week did not have a direct correlation to any significant events, some are blaming the Federal Reserve System or FED.

Two weeks ago, The Central Bank stated that inflation rates have raised this year. This statement made investors abruptly pull out on Monday, causing the biggest intra-day record with the Dow drop of 1,500 points. This drop mimics one that affected McQuaid Jesuit eight years ago: The Great Recession.

The Great Recession in December of 2009 severely affected the U.S economy, causing nationwide unemployment rates to skyrocket. Though the recession did not have a catastrophic effect on Rochester, enrollment did drop that year as well as the following year.

On Thursday the Dow finished with with a decline of 1,003 points. the second worst in US history following Monday’s horrendous loss of 1,175.

This drop in points last week leaves investors cautious and worrisome of the future of the stock market. Though the Dow did have record breaking lows last week, the market can bounce back as easily as it falls. Mrs. Colleen King, an investor and math teacher at McQuaid Jesuit, had a cautiously optimistic view.

“I think that the stock market will recover. It will take awhile to do so and will probably drop a little more next week. I think it will gain traction and return to where it was. It will probably take time to get there, but eventually we will see highs like we saw last month,” Mrs. King said.

The year has not been a good one for the Dow with record breaking lows and dismal intra-day turnarounds. Will the stock market ever fully regain its momentum, or will it crash, bringing the world economy with it? Time will only tell.